How to Write Cheque

In straightforward terms, a check is a significant record that can be utilized by any individual, association, or government to execute different assets. For any effective check move, the backer should keep functioning reserve funds or current records at a predetermined bank office. These checks are viewed as an issue-free technique for reserve move.

Notwithstanding, electronic techniques for reserve move have likewise become very famous during this time; However, check exchanges are as yet viewed as a protected method for executing cash between organizations in this country. As check is one of the most famous methods for cash move, we will let you know how to move cash securely through a check.

From this article of our own today, you will be aware of the principles of composing checks, how to compose actually looks at in your own name, and the right guidelines for composing cross-checks.

The most effective method to Write a Check –

In spite of the fact that there are various sorts of checks in our country, the principles for composing every one of these checks are practically something very similar. Thus, overall we talk about the dos and don’ts of actually taking a look at composing.

Rules to do:

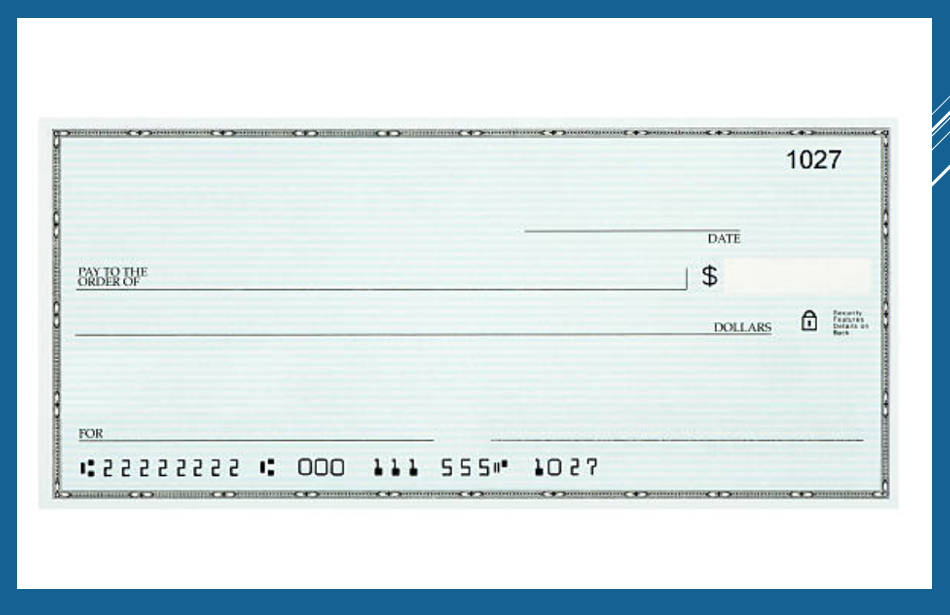

1. Toward the start of any check we really want to put two equals on the upper left half of the check.

2. In the date box you need to enter the right date and ‘for the sake of the payee’ section the name of the individual to whom the cash is to be paid and in the ‘pay’ segment how much cash ought to be placed once in numbers and once in words.

3. While composing the sum in numbers, the ‘/ – ‘ image ought to be composed toward the finish of the number close to the last digit.

4. Your bank-perceived mark ought to be set in the ‘signature’ space underneath the check.

Try not to Do Rules:

1. No overwriting or scrawls or scrawls on the checks.

2. Sum can’t contain more spaces among numbers and words.

3. No segment in the check can be left clear.

4. Checks can’t be collapsed or torn or stuck or stapled.

5. A reasonable bank-recognized signature should be given each time.

6. Payee’s name should be spelled accurately.

What is self-check?

The cabinet might give a self or self-check primarily for his very own advantage. Here “self” must be written in the cabinet name section. A self-check is drawn when the cabinet needs to pull out cash from his own financial balance for his own utilization. This check must be removed from the record holder’s or alternately cabinet’s bank. Also, this kind of check should be utilized cautiously, on the grounds that whenever it is lost, someone else can undoubtedly go to the cabinet’s bank and pull out the cash.

Rules for composing really look at in own name

Prior to filling a check in your name, you should follow its agreements. In these circumstances remember – You should have adequate equilibrium for your record to cover the sum referenced in the check. Self-check shouldn’t contain any overwriting or spelling botches. Just the mark of the cabinet ought to be placed in the ‘signature’ segment. Inability to conform to these terms might bring about check disrespect or actually looking at bob or crossing out. Here we have made sense of the subtleties of every section of self-check, how you can pull out cash from your own record –

1. Date:

Enter the date or dates on which the cash will be removed.

2. Payee or Payee:

Just check withdrawals in your own name are conceivable from the bank really take a look at them in your own name. For pulling out cash through this check, you need to compose the word ‘Payee’ or ‘Self’ in the payee section. Nonetheless, for this situation, you should have a record in your name at that bank office. What’s more, you can pull out cash from your check by composing ‘self’, if not it won’t be imaginable by any means.

3. Sum in Figure:

In the ‘Sum’ segment, you need to compose your sum in mathematical structure, putting a ‘/ – ‘ sign close to the last digit.

4. Sum in Words:

How much cash ought to be composed accurately in words.

What’s more, when it is written in word structure, the word ‘just’ must be added.

5. Signature:

To pull out cash from your ledger, you can do such the mark self-check kept with the bank while opening the record as a cabinet.

What are the kinds of Mastercards?

What is crossed or cross-check?

Crossed checks will be checks where two equal lines are crossed. You can utilize these two equal crosses across the whole check or on the upper left half of the check. This twofold line documentation implies that the check must be stored straightforwardly into a financial balance. Consequently, such checks can’t be promptly changed by any bank or some other credit association. Crossing permits you to follow the individual to whom you are paying. Also, in the event that the check isn’t crossed, it is called an open check.

Highlights of Crossed Check:

A crossed check guides a monetary establishment about how assets can be taken care of. Cross check is fundamentally utilized in nations like Europe, Asia, Mexico and Australia. With crossed checks, check holders can safeguard the cash moved from being changed or taken by unapproved people. Structures for crossed checks might shift from one country to another. Since got checks must be paid through a financial balance, it is feasible to follow the recipient’s exchange records for additional inquiries and explanations later.

Kinds of Crossed Checks:

Fundamentally, check crossing is of two kinds; Namely-General and Special Check Crossing.

What is a bank account?

1. General or General Check Crossing:

A general crossed check incorporates two equal lines across the face.

On which ‘not debatable’ is composed both.

In the event that such words are composed, the check is treated as an intersection.

In the accompanying cases, a check is viewed as a general crossed check-

At the point when two equal lines are drawn across the substance of the check.

At the point when the check contains the word ‘and company’ between two equal lines.

At the point when the check is of two equal lines